Strategic Industrial Deconsolidation: Optimizing Production Through Network Reconfiguration

Industrial leaders face mounting pressures to rethink their operational footprints. With increased geopolitical tensions, environmental concerns, and shifting customer expectations, the once-dominant model of massive centralized production facilities is giving way to a more agile approach. Strategic deconsolidation—the intentional redistribution of manufacturing capabilities across multiple smaller, specialized facilities—offers a promising alternative to traditional industrial concentration. This reimagining of production networks enables companies to place manufacturing closer to end markets, reduce transportation costs, and create redundancies that bolster resilience against disruptions while maintaining efficiency at scale.

Deconsolidation: Beyond Simple Decentralization

Strategic industrial deconsolidation represents a fundamental shift from the consolidation trend that dominated manufacturing strategy for decades. Traditional industrial development focused on economies of scale through massive centralized facilities. These megafactories allowed companies to optimize production costs through standardization, reduced overhead per unit, and streamlined logistics. However, this model created significant vulnerabilities.

The 2020 pandemic exposed these weaknesses dramatically as concentrated production hubs shut down, causing cascading failures throughout global supply networks. Even before this crisis, rising labor costs in traditional manufacturing centers, increasing transportation expenses, and growing concerns about carbon footprints had begun challenging the consolidated model. Strategic deconsolidation addresses these issues by creating networks of smaller, more specialized production facilities strategically positioned near key markets or resources.

Unlike simple decentralization, which might duplicate capabilities inefficiently across locations, strategic deconsolidation carefully allocates specific production processes to optimize the overall manufacturing network. This approach maintains scale efficiencies where beneficial while distributing risk and improving responsiveness to regional market demands.

The Economic Case for Production Network Reconfiguration

The financial benefits of strategic deconsolidation extend beyond risk mitigation. While the initial capital investment for multiple facilities may seem prohibitive compared to a single large operation, the total cost of ownership often proves more favorable over time. Transportation costs, which have increased substantially with rising fuel prices and environmental regulations, decrease significantly when production occurs closer to end markets.

Labor arbitrage opportunities also emerge as companies can selectively place labor-intensive operations in regions with competitive wage structures while keeping knowledge-intensive processes near talent pools. Tax incentives from municipalities eager for industrial development further improve the economics, with many regions offering substantial benefits to attract manufacturing facilities that bring employment opportunities.

Perhaps most significant is the revenue enhancement potential. Deconsolidated operations can respond more quickly to regional market demands, allowing for customization and faster innovation cycles. A Boston Consulting Group study found that companies employing strategic regional manufacturing networks achieved 15% higher average profit margins compared to those relying exclusively on centralized production, primarily through improved market responsiveness and reduced logistics costs.

Implementation Strategies for Successful Deconsolidation

Transitioning from consolidated to deconsolidated operations requires careful planning and execution. The most successful implementations begin with comprehensive network modeling that balances operational costs against resilience benefits. Advanced simulation tools now allow companies to evaluate thousands of possible network configurations against multiple risk scenarios and cost parameters.

Manufacturing process standardization provides the foundation for successful deconsolidation. Implementing consistent production methodologies, quality systems, and performance metrics across facilities ensures that products maintain uniform quality regardless of manufacturing location. This standardization also facilitates the transfer of best practices and enables workforce mobility between facilities.

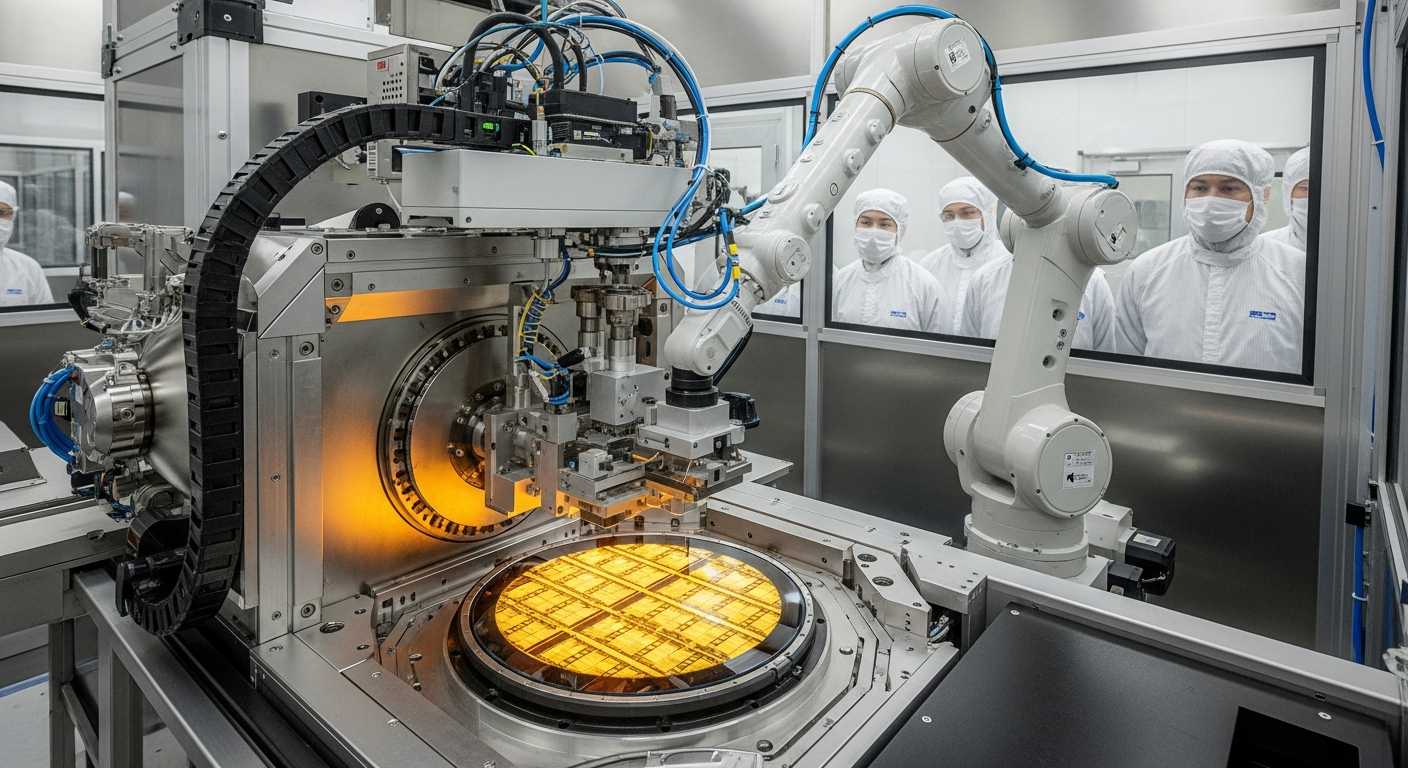

Technology plays a crucial role in binding deconsolidated networks together. Integrated manufacturing execution systems provide real-time visibility across facilities, while digital twins allow engineers to test process improvements virtually before implementation. Cloud-based enterprise resource planning systems coordinate planning and procurement across distributed operations, preventing inefficiencies.

A phased implementation approach typically yields the best results. Companies achieving the most successful transitions begin by establishing pilot facilities that validate the deconsolidation model before broader implementation. This approach allows for refinement of processes and technologies while maintaining operational stability during the transition.

Balancing Specialization and Redundancy

The most sophisticated deconsolidation strategies carefully balance facility specialization against the need for operational resilience. Pure specialization—where each facility produces only certain components or products—maximizes efficiency but creates single points of failure. Conversely, complete redundancy across all facilities protects against disruption but sacrifices scale economies.

Leading manufacturers have developed hybrid models that strategically duplicate critical capabilities while allowing specialization in non-critical areas. For example, an automotive supplier might ensure that critical safety components can be manufactured at multiple facilities while allowing regional specialization for interior components that have specific market preferences.

This approach requires sophisticated product architecture planning. Companies increasingly design products with modular architectures that allow for standard platforms manufactured at scale in multiple locations, while regionally-produced modules address market-specific requirements. This modular approach maintains efficiency while enabling the flexibility benefits of deconsolidation.

Cross-training workforce capabilities across facilities further enhances resilience. When production teams can transition between different product lines, companies gain additional flexibility to shift production during disruptions or demand fluctuations.

Future-Proofing Through Regional Manufacturing Networks

As industrial leaders look to the future, strategic deconsolidation positions them to navigate increasing uncertainties while capturing emerging opportunities. Geopolitical tensions and protectionist trade policies have accelerated the regionalization of supply chains, making distributed manufacturing capabilities increasingly valuable. Companies with established regional production networks can pivot more quickly when trade barriers arise.

Climate change considerations are also driving deconsolidation strategies. Manufacturing closer to end markets significantly reduces transportation-related emissions, helping companies meet increasingly stringent carbon reduction targets. Additionally, smaller facilities can more easily incorporate renewable energy solutions, with several manufacturers now operating carbon-neutral regional factories that would be more challenging to implement at massive scale.

The talent landscape further reinforces the case for distributed operations. While mega-facilities once dominated industrial employment in specific regions, today’s technical workforce is more geographically dispersed. Regional manufacturing networks allow companies to access specialized talent pools in different locations, from automation expertise in one region to materials science capabilities in another.

Essential Implementation Guidelines for Industrial Deconsolidation

-

Conduct comprehensive network modeling that assesses both cost implications and resilience benefits across multiple scenarios before finalizing facility locations

-

Begin with a capability map of existing operations to identify critical processes that require redundancy versus those that can be specialized regionally

-

Implement standardized production management systems across all facilities to ensure consistent quality and enable performance benchmarking

-

Develop clear criteria for production allocation decisions, balancing transportation costs, market responsiveness, and risk management

-

Invest in real-time visibility tools that provide consolidated production monitoring across all facilities to enable coordinated management

-

Create formal knowledge-sharing mechanisms between facilities to accelerate problem-solving and continuous improvement

-

Establish specialized centers of excellence within the network to drive innovation in specific manufacturing processes

-

Design clear escalation protocols for shifting production between facilities during disruptions

The transition to strategic industrial deconsolidation represents one of the most significant shifts in manufacturing strategy of the past several decades. By thoughtfully distributing production capabilities across multiple locations while maintaining standardization and coordination, industrial leaders are creating operations that combine the efficiency benefits of scale with unprecedented levels of resilience and market responsiveness. As global uncertainties continue to challenge traditional operating models, this balanced approach to production network design provides a compelling blueprint for manufacturing excellence in an increasingly complex industrial landscape.