Silicon Carbide: The Unsung Hero Powering Tomorrow's Electronics

The semiconductor industry is witnessing a quiet revolution as silicon carbide (SiC) emerges from the shadows of traditional silicon. This extraordinary compound, once relegated to industrial abrasives and jewelry, is now transforming power electronics, electric vehicles, and renewable energy systems with its superior thermal and electrical properties. As manufacturers race to adopt this technology, SiC is poised to become the backbone of our increasingly electrified world—promising devices that are more efficient, compact, and reliable than ever before.

The semiconductor that thrives where silicon fails

Silicon carbide isn’t exactly new—it was accidentally discovered in 1891 by Edward G. Acheson while attempting to create artificial diamonds. What makes SiC remarkable is its atomic structure, forming a crystal lattice that’s incredibly strong and stable. This translates to a wide bandgap semiconductor that can operate at temperatures exceeding 600°C, far beyond silicon’s practical limit of around 150°C.

The material’s thermal conductivity is three times higher than silicon, allowing faster heat dissipation in high-power applications. Perhaps most importantly, SiC can withstand electric fields ten times stronger than traditional silicon before breaking down. These properties make it ideal for high-voltage, high-temperature environments where conventional semiconductors simply cannot function.

For decades, manufacturing challenges and prohibitive costs kept SiC devices from mainstream adoption. The material is notoriously difficult to produce in large, defect-free wafers—a necessity for commercial semiconductor production. However, recent manufacturing breakthroughs have dramatically reduced costs and increased yields, setting the stage for SiC’s wider adoption.

Electric vehicles: The proving ground for SiC technology

The automotive industry has become silicon carbide’s most enthusiastic adopter, particularly in the electric vehicle sector. Tesla made waves in 2017 when it incorporated SiC power transistors into Model 3 inverters—the components that convert DC battery power to AC power for the motor. The results were impressive: smaller, lighter power electronics with enhanced efficiency.

SiC-based power systems can extend EV range by 5-10% through reduced energy losses during power conversion. They also enable faster charging capabilities and smaller thermal management systems, addressing key consumer concerns about electric vehicles.

The market impact is substantial, with estimates suggesting SiC content per electric vehicle could reach $500-$1,000 as adoption increases. Major automotive suppliers including Bosch, Denso, and Continental have invested heavily in SiC manufacturing capacity, signaling their confidence in the technology’s future. Tesla’s competitors haven’t been idle either—virtually every major automaker has SiC-based power systems in development or production.

Beyond automotive: SiC’s expanding applications

While electric vehicles represent silicon carbide’s most visible application, the material is making inroads across numerous industries. In renewable energy, SiC-based solar inverters are achieving efficiency ratings above 99%, compared to 96-97% for traditional silicon devices. This seemingly small difference translates to significant energy savings over a system’s lifetime.

Data centers, which now consume more than 2% of global electricity, represent another promising frontier. SiC power supplies can reduce energy losses by 30-50% compared to silicon-based solutions, potentially saving millions in operating costs for large facilities.

The aerospace industry has embraced SiC for its radiation hardness and high-temperature stability. NASA and other space agencies incorporate SiC components in satellite power systems and scientific instruments that must withstand extreme conditions.

Perhaps most intriguingly, SiC is enabling entirely new applications that weren’t previously possible. Ultra-fast charging infrastructure for electric vehicles relies heavily on SiC components to manage the enormous power levels required. Similarly, compact industrial motor drives using SiC can operate at switching frequencies that were unattainable with silicon, resulting in smaller, more responsive systems.

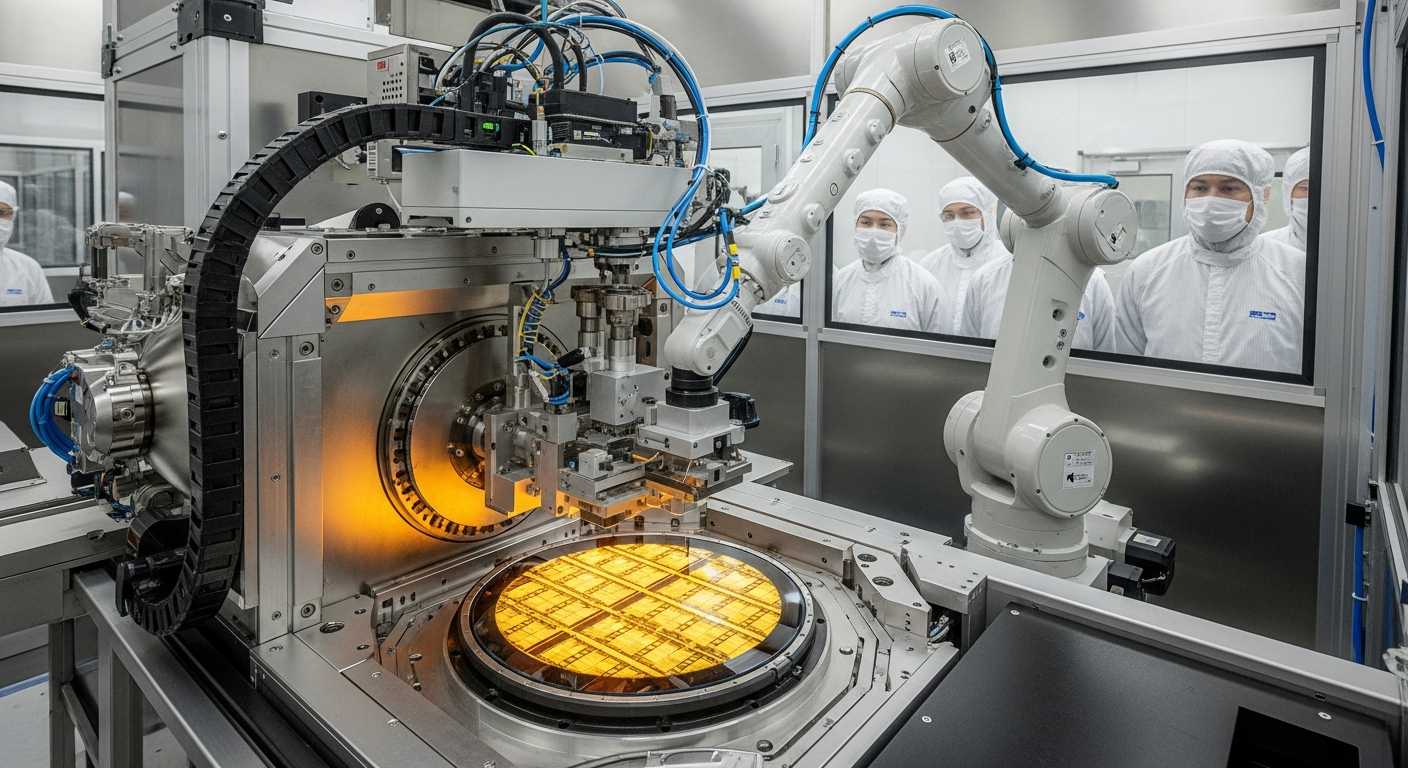

The manufacturing challenge: Scaling up production

Despite its promising attributes, silicon carbide faces significant manufacturing hurdles. The material’s exceptional hardness—the very property that makes it valuable for electronics—makes it difficult to cut, polish, and process into wafers. SiC crystals also contain microscopic defects called micropipes that can render chips unusable.

Industry leaders like Wolfspeed, STMicroelectronics, and Infineon have invested billions in overcoming these challenges. Their efforts are yielding results: wafer diameters have increased from 3 inches to 6 inches and now 8 inches, approaching the 12-inch standard of silicon manufacturing. Defect densities have dropped by orders of magnitude, while production volumes have soared.

These manufacturing advances have reduced the price premium for SiC devices from 10x to roughly 3-4x compared to silicon equivalents. Industry analysts expect this gap to narrow further as economies of scale take effect, potentially reaching just 1.5-2x within five years. At that point, the performance benefits will easily justify the modest price difference for many applications.

The competitive landscape and market outlook

Silicon carbide doesn’t exist in isolation—it competes with both traditional silicon and alternative wide-bandgap materials like gallium nitride (GaN). Each technology has found its niche: silicon maintains dominance in low and medium-power applications, GaN excels in the mid-range, while SiC rules the high-power, high-temperature domain.

The market for SiC power devices is projected to grow from approximately $1.1 billion in 2022 to over $6 billion by 2027—a compound annual growth rate exceeding 40%. This explosive growth has triggered a wave of mergers, acquisitions, and capacity expansions as companies position themselves for the SiC era.

The geopolitical dimension cannot be ignored either. Nations recognize semiconductor manufacturing as strategically important, with the US, EU, Japan, and China all providing incentives for domestic SiC production. This has accelerated capacity expansion worldwide, though concerns about supply chain security remain.

As silicon carbide continues its journey from niche to mainstream, its impact on electronics will only grow. For engineers, business leaders, and consumers alike, this remarkable material represents not just an incremental improvement but a fundamental shift in what’s possible from our electronic systems.